WeekInTime Special Edition: Along for the Ride

WeekInTime explores the history of panics, recessions, and depressions in this special edition

We live in a never-ending economic cycle. A cycle of booms and busts, where fortunes are made and then destroyed…to be built, hopefully, once again. This cycle affects individuals, families, businesses, and nations; an endless push and pull. And depending on the severity, the length of the cycle, and the collective memory of those involved, any given person might be convinced that the situation was unique to them—that never before has the economic outlook appeared so bleak.

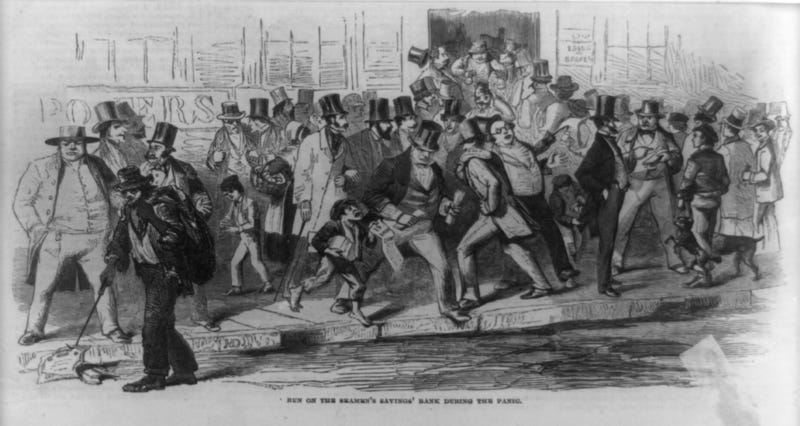

That’s not the case. History is full of instances of economic booms and busts. As we approach the end of June—the month that marks the end of the Great Recession of 2008, the largest economic collapse in many of our lifetimes—we wanted to dedicate this month’s special edition of WeekInTime to the history of panics, recessions, and depressions.

What are we even talking about here?

Before diving into the history, let’s talk about what recessions and depressions even are.

In short, there isn't a one-size-fits-all definition. The most common rule-of-thumb definition of a recession is two consecutive quarters of declining GDP. But in the U.S., “recessions” are determined by the National Bureau of Economic Research (NBER) Business Cycle Dating Committee, which uses the following definition:

“...a recession involves a significant decline in economic activity that is spread across the economy and lasts more than a few months…The determination of the months of peaks and troughs is based on a range of monthly measures of aggregate real economic activity published by the federal statistical agencies. These include real personal income less transfers, nonfarm payroll employment, employment as measured by the household survey, real personal consumption expenditures, wholesale-retail sales adjusted for price changes, and industrial production.”

…so basically a snoozefest way of saying that there are a range of factors that the NBER considers when determining whether the economy was in a recession. Economists Stijn Claessens and M. Ayhan Kose report that there were 122 recessions in 21 advanced economies between 1960-2007. Seem like a lot? Well, it turns out that those declines are just a fraction of the story. When one considers the percentage of quarters spent in recessions compared to quarters not in recessions during that same period, you end up at just about 10%—plenty of time to buy that McMansion.

Unlike their relatively normal, cyclical cousin, depressions are a far more serious matter. Again, there is no formal definition. But some consider a depression to be a very severe recession that typically lasts years, with GDP declines of at least 10%, which is why depressions are such a big deal when they happen.

Regardless of their official definitions, both recessions and depressions tend to shape the psyche, culture, and politics of their times. That’s why economists, historians, and policymakers have spent so much time trying to understand their causes.

What actually causes a recession or a depression?

There’s no precise formula for a recession, but there are some common causes. Here are just a few identified by the International Monetary Fund (IMF) and the U.S. Congressional Research Service (CRS):

Supply shocks that lead to price adjustments of inputs (e.g., oil embargo, natural disaster)

Government and central bank policies (e.g., an interest rate hike)

Financial crises (e.g., asset bubble, banking crisis, exchange rate crisis).

Although we may not always know the exact cause of a certain downturn, history offers plenty of examples that paint a picture of the factors that can influence a sudden change in economic fortune.

It’s a Roman FIRE…sale

Our first stop illustrates how government policy can both be the cause of and the remedy to a crisis. In 33 A.D., the old Roman Republic had breathed its last breath (thanks to this guy). Tiberius Caesar Augustus was now the emperor and “first citizen” of Rome. Still, members of the Senate continued to meet and accumulate power.

In the lead-up to the crisis, some senators found a new way to go after their political enemies. They turned to an old (and forgotten) law on the books that required creditors in the empire to invest a portion of their capital in Roman lands. As legal cases mounted and more of the elite came under scrutiny, Tiberius stepped in and declared a grace period to allow creditors to adjust their finances, legitimizing the old law.

Keep reading with a 7-day free trial

Subscribe to WeekInTime to keep reading this post and get 7 days of free access to the full post archives.